BlackRock Inc. (NYSE: BLK), the world’s largest asset management firm, reported its fourth-quarter and full-year 2024 earnings results on January 15, 2025. The company achieved record-breaking figures, reflecting its robust performance and strategic initiatives during the year.

BlackRock Inc. Overview

BlackRock Inc. has become a global leader in risk management, investment management, and advisory services for institutional and individual customers. The organization’s diverse product offerings include equities, fixed income, alternatives, and multi-asset strategies, catering to a wide range of investor needs. As of December 31, 2024, the firm managed assets totaling $11.6 trillion, underscoring its significant influence in the financial industry.

Financial Achievements of BlackRock Inc. in Q4 2024

In 2024, BlackRock Inc. reported full-year diluted earnings per share (EPS) of $42.01, or $43.61 when adjusted. For the fourth quarter, the diluted EPS was $10.63, or $11.93 as adjusted. These figures represent a 15% increase in full-year diluted EPS compared to the previous year.

The organization’s sales for the year rose by 14%, pushed by positive market impacts on average assets under management (AUM), organic base fee growth, and fees from assets acquired in the Global Infrastructure Partners (GIP) transaction. Additionally, higher performance fees and technology service revenue contributed to this growth. Operating income saw a 21%

increase, or 23% when adjusted, highlighting the firm’s operational efficiency.

BlackRock experienced record net inflows of $641 billion for the year, with $281 billion in the fourth quarter alone. These inflows were predominantly in exchange-traded funds (ETFs) and fixed-income products, reflecting investor confidence in BlackRock’s diverse investment offerings.

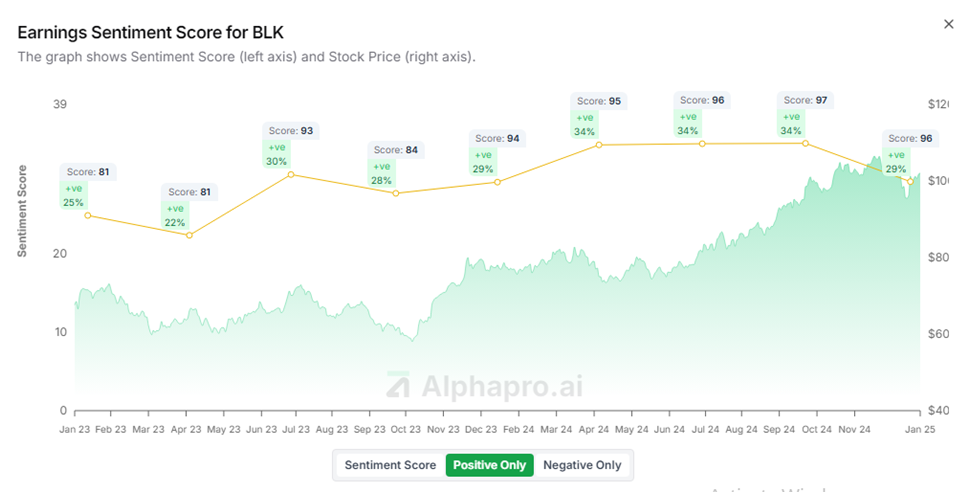

Positive Sentiments: Market Response

The substantial increase in assets under management (AUM) and net inflows underscores BlackRock’s strong market position and the effectiveness of its diversified investment strategies. The firm’s ability to attract significant capital inflows, particularly into its ETF offerings, highlights investor confidence in BlackRock’s products and management.

The impressive growth in adjusted EPS and revenue demonstrates the company’s operational efficiency and successful execution of its strategic initiatives. The market responded positively, with BlackRock Inc. stock price increasing by 4% following the earnings call announcement.

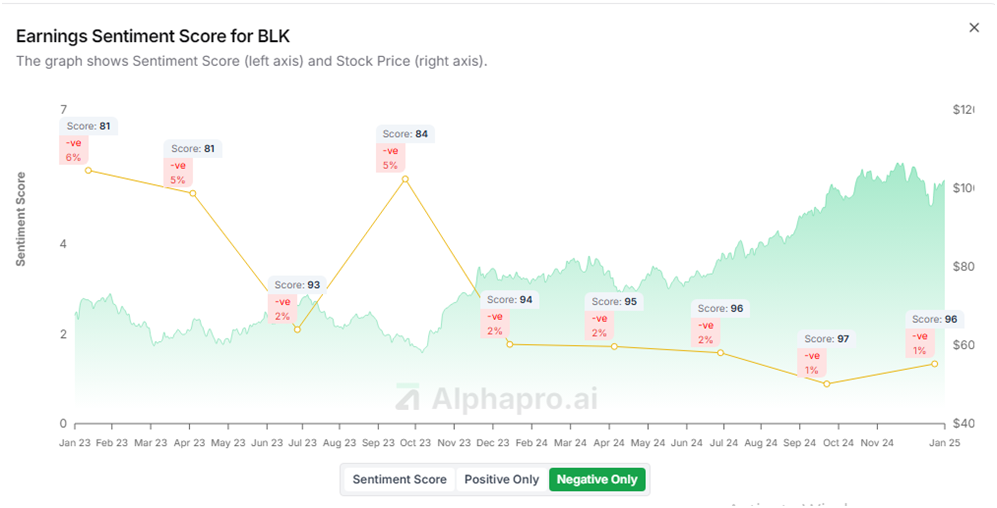

Negative Sentiments: Concerns Amid Growth

Despite the strong financial performance, BlackRock Inc. faces challenges, including increased employee compensation and benefits expenses, which rose by $382 million from the fourth quarter of 2023. The increase is primarily attributed to higher incentive compensation, elevated performance fees, and operating income.

Furthermore, the firm incurred higher general and administrative expenses, partly associated with acquisition-related costs from recent transactions. These rising expenses could impact profit margins if not managed effectively.

Conclusion

BlackRock Inc. Q4 2024 earnings highlight its ability to navigate a challenging market environment while delivering value to shareholders. The company’s continued focus on sustainable investments, technological innovation, and diversification positions it well for future growth. However, addressing fee compression and adapting to evolving regulatory landscapes will remain critical priorities in the coming quarters. Overall, BlackRock’s performance reaffirms its status as a market leader, balancing opportunities and challenges with strategic precision.