Delta Air Lines (NYSE: DAL) has delivered a strong set of financial results for the December quarter and the full year of 2024 and also provided its outlook for the March quarter and full year of 2025. The airline’s performance in both periods reflects its ongoing resilience, strong demand in the aviation sector, and operational performance. Let’s break down the important figures and insights from Delta’s latest earnings report and also assess the sentiment surrounding the airline’s performance.

December Quarter 2024 Financial Highlights

- Operating Revenue: $15.6 billion

- Operating Income: $1.7 billion, with an operating margin of 11.0%

- Pre-tax Income: $1.2 billion, with a pre-tax margin of 7.7%

- Earnings Per Share (EPS): $1.29

- Operating Cash Flow: $1.9 billion

- Debt and Finance Lease Obligations: $16.2 billion at quarter-end

Delta’s financial results for the December quarter are a testament to its strong execution. The operating income and revenue growth in the quarter reflect solid demand in both the corporate and leisure travel segments. The airline maintained profitability despite global challenges, closing the year with impressive results.

Capital Returns and Share Repurchases

Citigroup Inc. emphasized its commitment to shareholder value by repurchasing $1 billion in common shares during Q4 and returning nearly $7 billion to shareholders over the year. Furthermore, the bank announced an ambitious $20 billion share repurchase program, signaling confidence in sustained growth and financial strength.

Full Year 2024 Financial Results

- Operating Revenue: $61.6 billion

- Operating Income: $6.0 billion, with an operating margin of 9.7%

- Pre-tax Income: $4.7 billion, with a pre-tax margin of 7.6%

- Earnings Per Share (EPS): $5.33

- Operating Cash Flow: $8.0 billion

- Debt and Finance Lease Obligations:$16.2 billion at year-end

The full-year overall performance is even more impressive. Delta’s operating revenue grew by 4.3% from 2023, and its EPS (earnings per share) exceeded expectations, which demonstrates strong demand and operational strength. The company’s ability to generate a strong free cash flow of $3.4 billion and reduce its debt level is a positive sign for future stability and growth. Additionally, Delta has shown impressive resilience by maintaining a return on invested capital (ROIC) of 12.9%, showcasing efficient capital allocation.

Adjusted Full Year 2024 Metrics

- Operating Revenue: $57.0 billion, up by 4.3%, higher than the full year 2023

- Operating Income: $6.0 billion, with a 10.6% operating margin

- Pre-tax Income: $5.2 billion, with a pre-tax margin of 9.1%

- Earnings Per Share (EPS): $6.16

- Operating Cash Flow: $8.0 billion

- Free Cash Flow: $3.4 billion

Delta’s financial outcomes keep reflecting the ongoing strength of its premium offerings, mainly in long-haul and international travel. The airline’s premium products have helped to offset some of the cost pressures from fuel and labor.

Operational Performance

Delta has outperformed expectations by balancing a robust balance sheet with customer demand. The strong demand for both commercial enterprise and entertainment travel continues to fuel the airline’s growth. Additionally, Delta is optimistic about the future, projecting a 10% growth in earnings per share (EPS) for 2025 with a forecast of $7.35.

The airline’s ability to achieve a free cash flow of over $4 billion in 2025 further demonstrates its ability to weather any economic challenges that may arise in the coming months. Delta’s improved capital structure and forward-looking guidance give investors confidence.

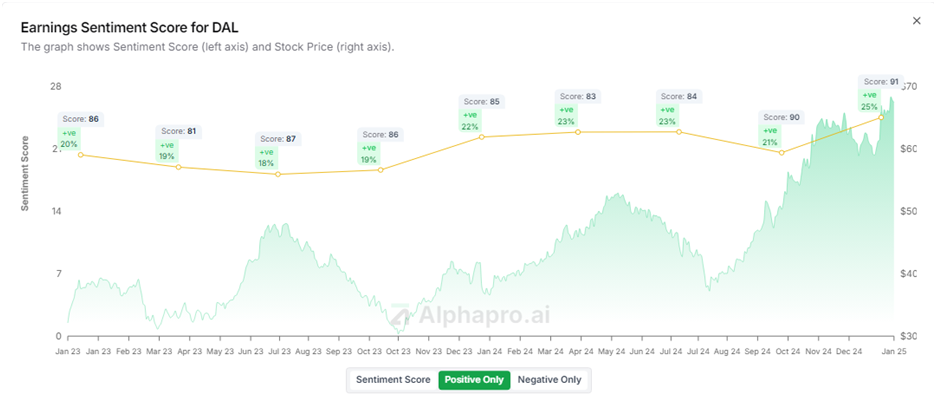

Sentiment Analysis of Delta’s Financial Results

In addition to evaluating the financials, it is important to look at the sentiment surrounding Delta’s performance. Here, we analyze both the positive and negative sentiments.

Positive Sentiment Analysis

Delta’s financial results reflect several positive aspects:

- Strong Growth: Delta has verified robust revenue growth and profitability in both the December quarter and the full year, which is a major driver of optimism.

- Operational Efficiency: The airline’s ability to manipulate costs and maintain a strong operational margin underpins its strong overall performance.

- Cash Flow and Capital Management: Delta’s ability to generate significant free cash flow and reduce debt enhances investor confidence in the airline’s long-term financial health.

- Positive Forward Guidance: The forecast of continued growth in 2025 with a projected 10% growth in EPS reflects confidence in Delta’s ability to navigate future challenges.

These factors contribute to a highly positive sentiment, as investors are generally optimistic about Delta’s future profitability and market position.

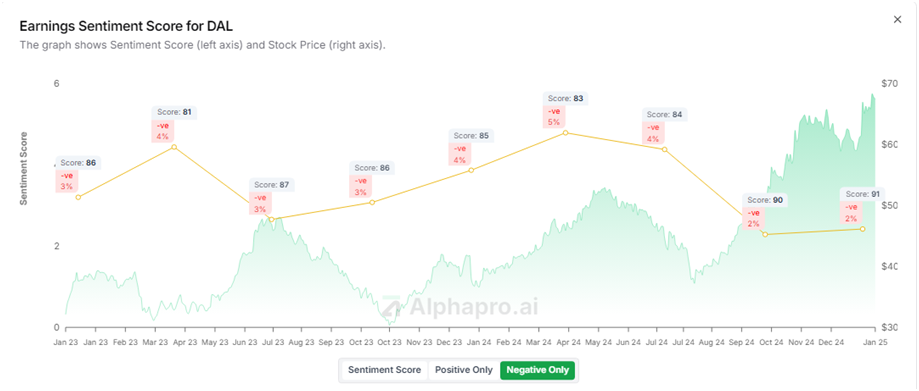

Negative Sentiment Analysis

While Delta has reported strong financial results, some negative sentiment stems from:

- Cost Pressures: Rising fuel prices and labor costs have been concerns for the airline industry as a whole. Although Delta has managed those expenses effectively, they remain risks to the airline’s profitability in the coming years.

- Debt Levels: Despite reductions in debt, Delta’s outstanding obligations of $16.2 billion remain a concern for some analysts. There may be market volatility, especially if global economic conditions change or interest rates rise.

- Global Uncertainty: Geopolitical instability and economic downturns are external risks that could affect Delta’s overall performance. While the airline has shown resilience, external factors can still affect travel demand and operational costs.

Closing Insights

Delta Air Lines (NYSE: DAL) has delivered impressive financial results for both the December quarter and the full year 2024, showcasing strong growth and operational efficiency. The airline’s ability to generate substantial cash flow, reduce debt, and manipulate expenses is a strong indication of its resilience in a challenging industry. While there are some concerns regarding external factors like rising costs and global instability, the company’s positive guidance for 2025 helps counterbalance these risks.

Overall, the sentiment surrounding Delta’s financial results is largely positive, with optimism fueled by strong performance, effective capital management, and a bright outlook for the year ahead.