Citizens Financial Group, Inc. (NYSE: CFG) reported its Q4 2024 earnings call transcript on January 17, 2025, showing steady financial performance despite a challenging economic environment. The report highlights steady revenue growth, improved net interest margin, and a strong capital position. The bank posted a net income of $401 million, translating to an earnings per share (EPS) of $0.83. On an underlying basis, net income stood at $412 million with an EPS of $0.85. The company also maintained a Common Equity Tier 1 (CET1) ratio of 10.8% and a loan-to-deposit ratio (LDR) of 79.6%.

For the full year, Citizens reported a net income of $1.5 billion with an EPS of $3.03 and an underlying EPS of $3.24. The figures reflect solid financial stability and effective capital management.

Key Financial Highlights

- Total revenue: $1.986 billion, up 4% QoQ

- Net interest income (NII): $1.412 billion, up 3% QoQ

- Net interest margin (NIM):87%, reflecting a 10 bps increase

- Period-end loans: $139.2 billion, down 1.7% QoQ

- Period-end deposits: $174.8 billion, stable QoQ

- Pre-provision profit: $670 million, up 4% QoQ

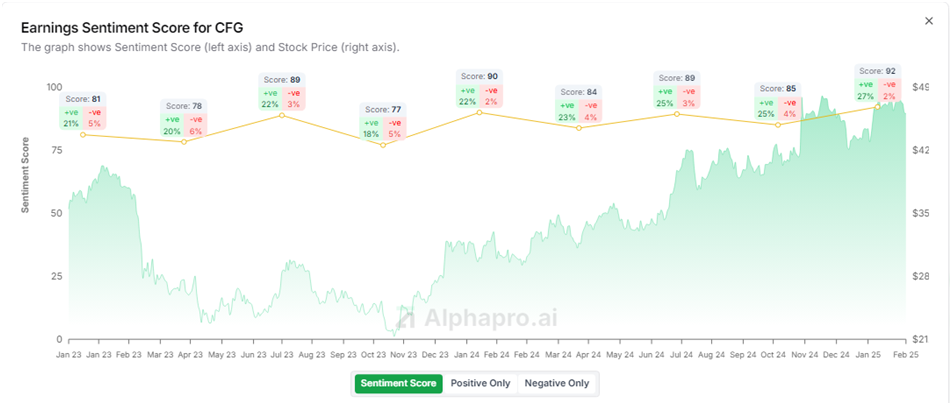

Investors and analysts responded positively to Citizens Financial Group’s improved net interest margin, growth in fee-based income, and strong capital position. However, concerns remain over loan portfolio contraction, rising expenses, and commercial real estate exposure.

Citizens Financial Group’s Positive Sentiment

Citizens Financial Group’s Q4 2024 earnings call transcript shows steady growth, driven by rising net interest income, expanding private bank operations, and strong capital markets performance. Net interest margin improved, while capital markets fees surged 29%, benefiting from loan syndication and M&A activity.

The Private Bank segment saw significant expansion, with $1.1 billion in new loans and $1.4 billion in deposits, reaching $7 billion. This growth strengthens CFG’s ability to attract high-net-worth clients.

CFG’s CET1 ratio of 10.8% and LDR of 79.6% reflect solid liquidity management. ROTCE improved to 10.7%, showcasing strong shareholder returns. Non-interest income rose 15% YoY, with mortgage banking fees up 30%, reinforcing CFG’s resilience and profitability heading into 2025.

Negative Sentiment: Challenges and Risks

Despite strong performance, Citizens Financial Group faces challenges, including a 1.7% decline in loan volumes due to lower C&I and CRE loans, partially offset by private bank growth. Operating expenses rose 3.5% due to investments in private banking and commercial banking, adding short-term cost pressures. Nonaccrual loans increased to 1.20%, reflecting higher credit risks, particularly in commercial real estate. Additionally, tangible book value (TBV) per share fell 3.6% to $32.34, impacted by rising long-term interest rates.

Future Outlook for 2025

Looking ahead to 2025, Citizens Financial Group, Inc. (NYSE: CFG) remains optimistic about sustaining revenue growth and improving efficiency. The organization plans to expand private banking, improve capital markets, and carefully manage its loan portfolio to balance risk and growth. By optimizing its deposit and lending strategy and investing in technology, CFG aims for long-term stability. While challenges like loan contraction and rising expenses persist, strategic investments and strong operations position the company for continued success.

Conclusion

Citizens Financial Group, Inc. (NYSE: CFG) delivered a robust overall performance in the Q4 2024 earnings call transcript, showcasing better profits, improved net interest margin, and regular deposit growth. The corporation’s expansion in private banking and capital markets activities will drive future growth. However, declining loan volumes, rising credit risk, and increased prices are regions of difficulty. Despite these challenges, CFG remains well-positioned for sustained profitability and financial stability in 2025.