While financial markets are generally dynamic and complex, sentiment analysis for stock prediction has become the core technique to enhance stock market performance. Sentiment analysis uses an advanced algorithm and natural language processing to derive meaningful insights from overwhelming text data. This blog looks at the impact of sentiment analysis of stocks on investment and market decisions.

While financial markets are generally dynamic and complex, sentiment analysis for stock prediction has become the core technique to enhance stock market performance. Sentiment analysis uses an advanced algorithm and natural language processing to derive meaningful insights from overwhelming text data. This blog looks at the impact of sentiment analysis of stocks on investment and market decisions.

Understanding Sentiment Analysis in the Stock Market

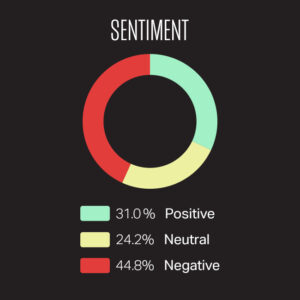

Stock market sentiment means assessing the masses’ overall disposition regarding certain stocks or the market in general. It entails the process of determining investors’ attitudes by identifying words in news articles and social media posts, as well as expressed sentiments in financial reports and balance sheets, among other textual forms. The first aim is to establish if the identified sentiment is positive, negative, or even neutral, as this can be powerful in determining whether there will be the next possible move in the stock’s price.

The importance of sentiment stock analysis stems from its forecasting aim. For instance, if an organization has a positive event, such as encouraging earnings reports or releasing a new product version, it triggers the stock port. On the other hand, negative feelings derived from scandals or bad earnings signal a possible deterioration in value.

Execution of Sentiment Analysis for Stock Prediction

Several steps are followed for sentiment analysis in stock market prediction. First, information is gathered from the target audience through other platforms such as news articles, blogs, and social networks. Following this, sophisticated methods are used to parse these synthesized data to understand sentiments and patterns. This process is frequently based on machine learning models, which can develop during their work.

The information provided herein enables investors to apply their trading strategies. For instance, an abrupt increase in negative tone in a sector will make traders or investors consider adopting a short-sell approach to equities in this niche—likewise, positive sentiment points to long entries. By using analysis of stocks, traders can improve their chances of profiting from changes in the stock market.

The Impact of Sentiment Analysis on Investment Decisions

Analysis is very influential in the stock market decision-making process. People involved in investment activities are the primary beneficiaries of developing sentiment analysis tools because they give them a better sense of the market. What is more, this analytical approach helps to clear a visionary view of possible risks and opportunities.

In addition, sentiment analysis can also be helpful as an alert to investors. By constantly analyzing sentiments on different sites, financial institutions can see new trends to invest in and adapt their portfolios. Of course, this approach is less risky, especially since drastic market changes can sometimes be unpredictable.

However, one needs to understand that analysis for stock prediction can be very informative; however, it cannot be said to be accurate. Text-based information is often colored by subjectivity and may be interpreted differently depending on the surrounding circumstances. Furthermore, some trends may incorporate other aspects, such as sarcasm or Irony, that could make extracting sentiment a bit challenging.

Limitations and Challenges

Nevertheless, sentiment analysis of stocks has several challenges. Language is subjective by nature, creating significant challenges; words used in financial statements or on Twitter may not convey the intended message. In addition, the presence of noise that comprises unwanted information or bias can also interfere with sentiments.

Another concern is that the textual information came from various sources, both in product and quantity. This means there is likely to be a high level of fake news and manipulative content that will, in one way or another, cause a wrong sentiment assessment, possibly influencing the investors. To overcome these challenges, constant development of the fundamental machine learning concepts for sentiment analysis is required to enhance the performance of the models.

Integrating Sentiment Analysis with Traditional Methods

To get the best result from sentiment stock analysis, it is appropriate to combine the findings with financial fundamentals. Appending the sentiment data with the primary analysis of firms’ financial statements and economic indexes enables the generation of broader overviews of possible investments.

Entailing these findings, the role of sentiment analysis will likely advance with the development of technology in the stock market. Banks and other financial institutions have started to implement and deploy complex algorithms that enable them to underwrite with more accuracy while at the same time avoiding the possibility of poor underwriting that comes with conventional methods.

Embracing Sentiment Analysis

Sentiment for stock prediction is, by the words of the title, a transformed approach to understanding the behavior pattern of the market. Therefore, through this analytical tool, investors will generate valuable information on public sentiment and make more informed decisions.

Much remains to be desired in interpreting sentiment and reducing biases, but technology is advancing and promising to be reliable when using models built on sentiment analysis. When more investors slowly begin embracing new methods, such as this innovative approach, in addition to some traditional methods, they will be better at handling today’s financial market complexes.