The investment banking deals in 2024 suggest that the sector is evolving continuously. It is driven by the demand for digital transformation, changing economic paradigms, and opportunities in emerging new spaces such as sustainable finance, blockchain, or reg tech. For banks to successfully navigate this, they need the tools and resources to innovate effectively, act fast, and make decisions confidently.

The investment banking deals in 2024 suggest that the sector is evolving continuously. It is driven by the demand for digital transformation, changing economic paradigms, and opportunities in emerging new spaces such as sustainable finance, blockchain, or reg tech. For banks to successfully navigate this, they need the tools and resources to innovate effectively, act fast, and make decisions confidently.

In our analysis of these trends, you will see that artificial intelligence (AI) and intelligent market intelligence solutions will be hugely valuable for keeping firms competitive and giving them an edge in uncertain markets. Banks adopting and implementing these solutions will have a clear competitive advantage.

Below, we explore the top trends in investment banking and essential considerations for investors and firms as they build strategies for the months and years ahead:

- The Transformative Power of GenAI

- Stabilization of Interest Rates and Possible Decline in the Future

- Growth of Environmental Finance

- Climate Change and Decarbonization

- Distributed ledger technologies and blockchain

- Adoption of RegTech

- Advanced-Data Protection and Cybersecurity

- Transition to Private Credit

Key Takeaways

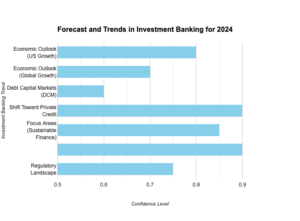

- Generative AI is likely to greatly benefit the banking industry, as it is already revolutionizing the way investment banks plan and make decisions.

- The Fed is anticipated to announce interest rate reductions in September 2024 since inflation is finally stabilizing after a protracted period of high interest rates.

- Decarbonization and sustainability will remain priorities to satisfy investors’ and consumers’ demands.

- 2024 will see a greater use of blockchain in the investment banking industry.

- RegTech is becoming a need in order to manage more complicated regulatory and compliance environments.

- New technologies are increasing the need to invest in more advanced cybersecurity and data protection measures.

- Due to significant dry powder following a sluggish year of departures, private lending is becoming increasingly popular as a primary source of capital.

Investment Banking Trends in 2024

This is an ongoing, exacerbated transformation within the investment banking sector, driven by rapid technological advancement, rapidly changing economic landscapes, and innovative new opportunities in sustainability, portfolio diversification, and beyond, all shaping the evolution of investment banking terms.

Here, we will delve further into these trends and how they will affect market dynamics in the second half of 2024 and beyond.

GenAI As a Transformative Force

In 2024, generative AI (genAI) will be an impactful force in just about every business sector, and that’s not the case with investment banking either. Investment banks are leveraging genAI for a broad set of strategies, from client service to investment decision enhancement to operational efficiency.

It makes routine tasks and even a complex set of finance analyses completely automatic and faster, and with that, the scale of deals that can be sourced and how fast they can be decided upon are all leveled up. With the ability to analyze more data than ever in 1 less time, one more accurately, and one more decisively, data analytics is enabling even faster, more precise, and more informed decision-making than ever before — surfacing new opportunities in the investors and in doing so making the playing field more competitive. Now, banks must invest in putting genAI tools in place and maintaining them to support advisory services—cement, fast-changing economic landscapes, innovative new sustainability opportunities, portfolio diversification, and more.

Interest Rate Stabilization and Potential Reduction on the Horizon

As central banks worldwide struggle to bring stubbornly high inflation under control, they have kept interest rates high throughout 2024. Thus, banks found themselves forced to rethink their approaches to structuring deals, financing them, and advising their clients to cushion them from the firehose of higher rates. Today, many are increasingly turning to AI and real-time data analytics-powered market intelligence tools to make more informed decisions and provide more personalized advice to each client.

This means that inflation rates are creeping closer to target levels, which now causes the Fed to be expected to cut interest rates in September 2024. In a slash-and-burn style, this will provide investment banks with much-needed business, but the profit per loan will be reduced.

Banks’ overall success in 2024 and beyond will continue to hinge on adaptability. The Fed’s decisions mean that banks must be ready to adjust their strategy to align with them or risk falling behind to remain competitive.

Rise of Sustainable Finance and ESG Investments

Unlike many ESG, structured, regulated sustainable finance is nothing new in the investment banking scene, but in 2024, it will be given a significant focus. This is, however, a continuation of the ultimate shift in the ethos of financial decision-making as banks and financial institutions increasingly incorporate ESG factors as part of an investment strategy not just to meet the rising demand for a socially responsible investor base but also to manage risk, establish their institutional position, and, most importantly, to remain competitive in the digital world.

Further momentum is building around the world for sustainable finance and investor transparency through regulatory frameworks such as the EU’s Sustainable Finance Disclosure (SDFU) and the SEC’s updated ‘name rule,’ which requires that 80 percent of a fund’s portfolio aligns with the advertised asset by its name.

This is more in line with a wider belief that in the future, sound investments and social responsibility will be one choice.

Decarbonization and Climate Change Initiatives

A related trend is that more and more investment banks are aligning their financing and advisory services with global decarbonization and project work that aims to lower the carbon footprint. Its push is a big change in major world economies like the U.S. and China towards becoming low carbon.

Investment banks are developing several financial products and services to satisfy the rising demand for sustainable investments. These services include advisory work, business practice guidance, and ensuring that funding goes towards renewable energy projects.

The Federal Reserve worried last year about the effect of strict climate regulations approved by the European Central Bank at the behest of the Basel Committee, a global organization charged with guiding banks with standard guidelines. Under the newly proposed rules, banks must publish more details about how climate change could affect their business from January 2026. However, the Fed has pushed back on this proposal, saying it has no plans to become a climate policymaker. A modified proposal will be released sometime near the end of 2024.

While banks aren’t held to the strict terms of climate regulation by a global governing body, they will still take steps to become more sustainable and decarbonize to meet the requirements of investors and customers. Bank financing will be the main driving force of the energy transition, as it needs inspiration, funding, new technology, and innovation to execute many of these projects.

Blockchain and Distributed Ledger Technologies

In 2024, banking takes blockchain and distributed ledger technologies very seriously, with the promise of less vulnerable, more transparent, and more efficient financial systems streamlined payments to smart contracts that automatically take effect, up to boosted cybersecurity and fraud detection, not to mention convenience.

Of course, adopting blockchain technology may not only rely on technological advancements but also support trust and transparency in financial transactions, which makes financial data integrity.

This includes the European Investment Bank, which combined blockchain with environmentally conscious financial products by issuing its green bonds on blockchain.

You see how European investment banks have teamed up with the Unreal DAO to seed a $30m fund to support blockchain start-ups in developing the next generation of blockchain innovation. Again, this indicates the EIB’s commitment to the widespread growth and development of blockchain.

This is because J.P. Morgan recently launched the hot blockchain trial apps for offering dollar-based settlement services to Indian banks, indicating that blockchain can reduce workflow processes and scale international financial transactions more efficiently. Banks could make 24/7 dollar payments and achieve instant settlements in India’s GIFT City for India’s financial needs — using the same technology — eliminating the issues of time zones within international finance.

It’s also driving the boom in digital currencies and cryptocurrencies in over 130 countries focused on CBDCs. All these indications speak to the fact that in 2024, we will see blockchain moving into the mainstream even more from the investment bank perspective.

RegTech Adoption

RegTech investment by the banking sector is gathering pace ahead of 2024 as it seeks to steer through a complex and evolving regulatory landscape. According to forecasts, RegTech spending will soar to nearly $67 billion by 2032, surpassing $15.7 billion in 2020. The need for advanced solutions to keep pace with regulatory complexity and investment banks’ scaling drives this growth.

In 2024, Banks will use automation and AI to implement RegTech. Automating the process tremendously lowers the cost of running compliance efforts and provides machine learning and analytics capabilities to improve the quality of analysis.

In this case, these technologies can parse datasets to spot a pattern of behavior indicative of possible fraud or abnormality (i.e., something that simply can’t be detected manually) that could lead to an unintentional failure to comply, which is growing faster than we can invent mirrors.

Advanced Cybersecurity and Data Protection

With the adoption of new technologies such as AI, blockchain, the cloud, etc., by more and more investment banks, the threat landscape is becoming more complex and sophisticated. The risk is even higher for the industry, where a security breach is costlier on average than the global average, at $6m, 28% more.

As AI technologies make breakthroughs and cyber hackers continue exploring new avenues, venture capital firms are investing in cybersecurity startups. This trend will benefit investment banks by fueling innovation in banking-focused cybersecurity and cranking out alliances that they can roll out into their infrastructure.

India, in particular, is a market to watch in this space. In the past two years, Indian cybersecurity startups collected $130 million in funding, more than double what they received in the two years prior.

Shift Toward Private Credit

Investment banking 2024 is a trend in which private capital markets growth will be a key point. Following a frustrating year of exits and growing investor allocations to the asset class, private credit is gaining steam as a significant funding source due to massive dry powder.

Private market financing is adapting, and investment banks are responding by offering specialized advice and developing private funding products that are uniquely for private investors and privately funded companies.

Private credit and alternative investment platforms are increasingly being pushed into adopting more junior and hybrid capital demand. However, this trend represents a shift towards more diverse and flexible modes of funding in the investment banking realm, which is not surprising since investment banking caters to investors’ current needs and the changing dynamics of an ever-evolving global economy.