On January 15, 2025, Goldman Sachs Group, Inc. (NYSE: GS) reported its fourth-quarter 2024 earnings call, showcasing a robust financial performance that surpassed market expectations. The firm’s net revenues of $53.51 billion and net earnings of $14.28 billion for the year ended December 31, 2024, a 16% year-over-year increase. Net revenues were $13.87 billion, and net earnings were $4.11 billion for the fourth quarter of 2024.

Diluted earnings per common share (EPS) was $40.54 for 2024 and $11.95 for the fourth quarter of 2024. Return on average common shareholders’ equity (ROE) was 12.7% for 2024, and annualized ROE was 14.6% for the fourth quarter of 2024. Equity trading revenue increased by 32%, while fixed income, currency, and commodities trading revenue rose by 35%. Goldman Sachs Group, Inc. capitalized on favorable trading conditions, driven by market volatility, to achieve these gains.

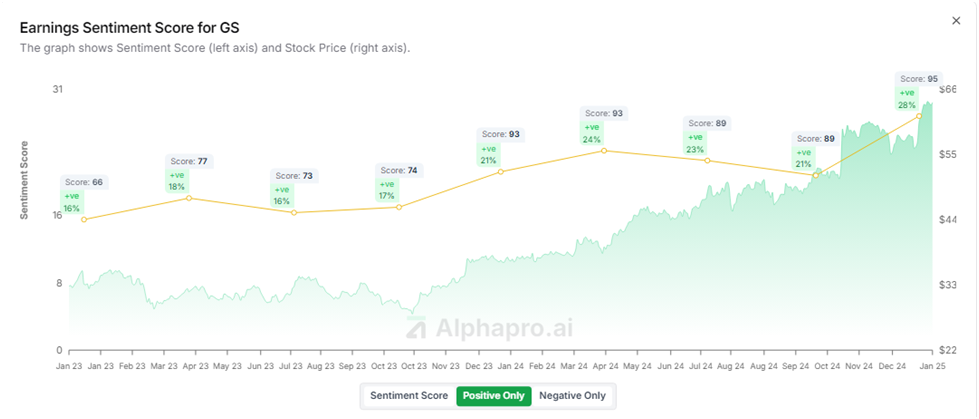

While the effects imply a robust comeback from previous financial slowdowns, inner agency dynamics have prompted sentiment around those earnings.

Positive Sentiment Analysis

1. Strong Investment Banking and Trading Performance

Goldman Sachs Group, Inc. (NYSE: GS) ability to generate revenue from investment banking and trading has strengthened its position as a market leader. Investors responded positively to the company’s ability to navigate market volatility successfully.

2. Beating Market Expectations

The bank’s EPS of $11.95 exceeded analyst projections of $8.22, signaling stronger-than-expected profitability. This wonderful marvel reassured shareholders and helped enhance Goldman Sachs Group, Inc.’s stock rate in the short term.

3. Solid Annual Growth Metrics

The 16% year-over-year revenue increase highlights the firm’s ability to sustain growth. The investment banking sector’s resilience and adaptability have fueled long-term optimism about the company’s strategic direction.

4. Improved Business Diversification

Goldman Sachs has been expanding its focus beyond traditional investment banking by investing in technology and alternative financial services. This diversification strategy reduces dependency on market fluctuations, strengthening long-term stability.

Negative Sentiment Analysis

1. Employee Discontent Over Bonuses

Despite the strong earnings, internal dissatisfaction among Goldman Sachs Group, Inc. (NYSE: GS) employees has emerged as a major concern. CEO David Solomon’s $39 million compensation package (a 26% increase from the previous year) and an additional $80 million retention bonus sparked frustration among employees, especially as some received lower-than-expected bonuses. Discontent within the workforce could affect productivity and morale in the long run.

2. Decline in Advisory Revenue

While investment banking and trading flourished, Goldman Sachs’ advisory revenue saw a 4% decline in Q4 2024. This suggests a slowdown in deal-making activity, which could impact future earnings if this trend continues.

3. Market Uncertainty and Volatility Risks

Although trading revenues were strong in Q4 2024, market fluctuations introduce uncertainty. A downturn in economic conditions could challenge Goldman Sachs’ ability to maintain steady financial performance, given its reliance on trading profits.

4. Reputation and Leadership Concerns

The controversy surrounding CEO David Solomon’s high compensation has sparked concerns about leadership priorities. Critics argue that disproportionate executive bonuses could impact employee trust and retention, potentially affecting the company’s long-term growth.

Conclusion: Goldman Sachs Group, Inc.’s Path Forward

Goldman Sachs Group, Inc. (NYSE: GS) Q4 2024 earnings call report reflected a strong financial performance, demonstrating resilience and strategic growth in key business areas. The investment banking and trading divisions outperformed expectations, and the bank’s overall profitability remains solid. However, internal discontent over compensation and a slight decline in advisory revenue have introduced challenges that the company must address.

While investors are generally optimistic about the bank’s financial strength, employee dissatisfaction and leadership controversies could pose long-term risks. Moving forward, balancing strong financial performance with internal stability will be key to Goldman Sachs Group, Inc. continued success.