J.B. Hunt Transport Services, Inc. (NASDAQ: JBHT) released its Q4 2024 earnings call transcript, showcasing a mix of revenue declines, operational efficiency gains, and ongoing market challenges. The company’s results reflect both positive momentum in some areas and pressures from cost-related factors. Let’s dive into the key financial highlights, segment performance, and overall sentiment analysis.

J.B. Hunt Transport Services, Inc. Key Financial Highlights

- Revenue: $3.15 billion, down 5% from Q4 2023.

- Revenue excluding fuel surcharge: $2.78 billion, down 2%.

- Operating Income: Increased 2% to $207.0 million.

- Diluted Earnings Per Share (EPS): $1.53 (up 4% from $1.47 in Q4 2023).

Segment Performance Analysis

The Intermodal (JBI) segment faced a revenue decline due to lower revenue per load, despite increased volume. Dedicated Contract Services (DCS) saw revenue drop 5% to $839 million, while operating income rose 5% to $90.3 million, driven by improved truck productivity. Integrated Capacity Solutions (ICS) revenue fell 15% to $308 million, though operating losses narrowed to $21.8 million from $24.9 million. Load volume dropped 22%, but revenue per load grew 9%, boosting gross profit margins to 17.3%. Final Mile Services (FMS) revenue decreased 6% to $228 million, while operating income increased 7% to $13.2 million, helped by better revenue quality and new contracts. Truckload (JBT) revenue declined 7% to $182 million, but operating income rebounded to $8.6 million from a slight loss in Q4 2023, thanks to improved trailer utilization and cost management.

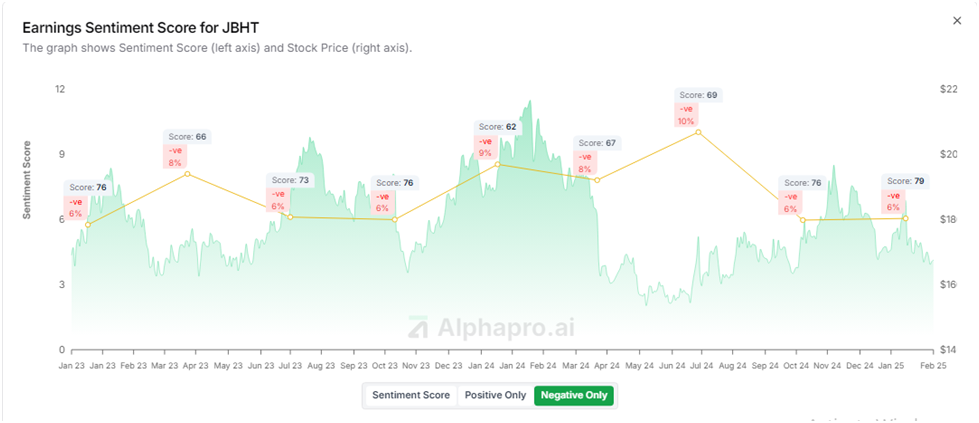

Positive Sentiment Analysis

J.B. Hunt Transport Services, Inc. showed resilience in the face of revenue declines by increasing operating income across many divisions, showcasing effective cost management. The 5% volume rise in the intermodal segment suggests strong demand, particularly for eastbound loads from Southern California. The ICS segment saw gross profit margins improve to 17.3%, indicating a more disciplined pricing strategy. Additionally, the J.B. Hunt Transport Services, Inc. segment’s return to positive operating income highlights trailer utilization and cost efficiency improvements, reinforcing the company’s ability to navigate a challenging freight market.

Negative Sentiment Analysis

While J.B. Hunt Transport Services, Inc. experienced growth in operating income in some areas, revenue declines persisted across most segments, reflecting broader market challenges. The JBI segment struggled with higher repositioning costs and rising labor expenses, contributing to a 10% drop in operating income. ICS faced a 22% drop in load volume, raising concerns about overall demand in the segment. Additionally, inflationary pressures, including increased insurance, labor, and fuel costs, continued to impact the company’s profitability across multiple business units.

Conclusion and Outlook

While J.B. Hunt Transport Services, Inc. navigated a challenging market environment with revenue declines in all major segments, its focus on cost management, contract pricing adjustments, and network efficiency improvements helped stabilize operating income. The company aims to leverage its strategic investments, intermodal expansion, and operational efficiencies to drive long-term growth in a fluctuating freight market.

The outlook remains cautiously optimistic, with continued investments in technology, capacity, and operational efficiencies expected to support future earnings stability. However, macroeconomic factors, including inflation, fuel costs, and demand fluctuations, will remain key challenges in 2025.