Netflix (NFLX) recently announced its Q4 2024 earnings report, revealing some surprising milestones and challenges. By concentrating on financial performance, subscriber increases, and strategic initiatives, this quarterly reporting has been creating much heat in the eyes of investors and analysts. Below are the details of Netflix Q4 2024 performance, financial highlights, and the positive and negative sentiment analysis.

Company Performance

Netflix announced a record-breaking quarter, adding 18.9 million new subscribers, taking its paid membership base to 301.6 million, up 15.9% year-on-year (YoY). The company’s earlier largest gain was in the first quarter of 2020, when it added 15 million subscribers at the beginning of the COVID-19 pandemic. This growth marks a 7% increase from the prior quarter and solidifies Netflix’s position as the most popular streaming platform worldwide. The company attributed this surge to the success of several high-profile releases, including the latest season of Squid Game, the launch of new live sports programming, and exclusive blockbuster films.

To further enhance its offering, Netflix expanded its ad-supported subscription tier, which gained significant traction this quarter. Approximately 55% of new subscribers opted for this more affordable plan, driving ad revenue growth.

Financial Highlights

In Q4 2024, Netflix surpassed Wall Street’s forecasts in several important financial metrics:

- Revenue: $10.25 billion, up 16% from the previous year and more than the $10.11 billion analysts had predicted.

- Earnings per share (EPS): $4.27, up from $2.13 in Q4 2023 and above the expected $4.19.

- Operating Income: $2.3 billion, reflecting a 52% increase, with an operating margin of 22%.

Free Cash Flow: Over $1.3 billion, signaling Netflix’s efficient cost management and ability to fund future growth initiatives.

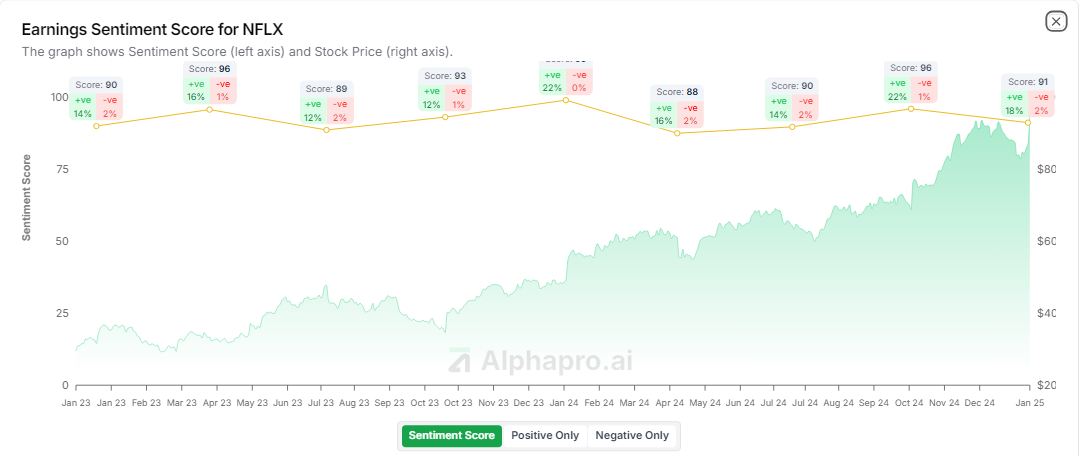

Positive Sentiment Analysis

Netflix’s Q4 2024 earnings have generated positive sentiment across the industry.

- Subscriber Growth: The addition of 18.9 million subscribers is the company’s largest quarterly growth to date, demonstrating its strong content strategy and global appeal.

- Ad-Supported Plan Success: By offering competitive prices, the ad-tier model drew in a wide range of viewers and significantly increased ad revenue.

- Stock Performance: Following the earnings report, Netflix’s stock surged nearly 10%, hitting an all-time high of $953.99. Investors remain optimistic about the company’s growth trajectory.

Negative Sentiment Analysis

Despite the positives, there are criticisms of some sectors in Netflix’s Q4 report:

- Price Increases: Subscription price hikes in the major markets are causing concerns that the customer churn rate might increase in the regions where price is a major factor.

- Content Costs: This significant investment in original content and live sports programming has driven up the cost. This could squeeze margins in the coming quarters.

- Intense Competition: Some of the rival competitors, like Disney+, Amazon Prime Video, and HBO Max, among others, are always competing for that market share of Netflix.

Future Outlook

Looking ahead, Netflix projects 2025 revenue to range between $43.5 billion and $44.5 billion, reflecting confidence in its potential to sustain growth. The organization wants to develop its portfolio with more unique and original content, expand its advertising business, and explore new revenue streams through live sports and gaming.

Analysts remain largely bullish, with many raising their price targets. However, they caution that Netflix must carefully balance content investments and pricing strategies to maintain its competitive edge.