The Bank of New York Mellon Corporation (BNY) released its Q4 2024 earnings call transcripts on January 15, 2025. Strong revenue growth, strategic breakthroughs, and enhanced cost management were all showcased in the financial performance. Even though the performance was good, there were a few issues that needed to be addressed.

The Bank of New York Mellon Corporation (BNY) Q4 2024 Financial Performance

Strong Revenue Growth and EPS Beat

BNY Mellon reported adjusted earnings per share (EPS) of $1.72, significantly surpassing Wall Street estimates of $1.65 per share. This marked an increase from $1.29 per share in the same quarter of 2023, reflecting a 33% year-over-year (YoY) improvement.

Total revenue reached $4.85 billion, up 11% from Q4 2023, driven by an increase in fee-based revenue and net interest income. The company’s ability to sustain growth amid a fluctuating macroeconomic environment signals strong operational resilience and strategic efficiency.

Full-Year 2024 Performance

For the full year 2024, The Bank of New York Mellon Corporation (BNY) reported:

- Net income of $4.3 billion, marking a record high.

- Total revenue of $18.6 billion, reflecting consistent revenue expansion.

- Return on tangible common equity (ROTCE) of 23%, a strong metric for profitability.

- Net interest income (NII) of $1.19 billion, an 8% YoY increase. This growth resulted from improved asset yields and a strategic expansion of the balance sheet.

- Fee revenue of $3.51 billion, up 9% YoY, primarily driven by strong market activity and business acquisitions.

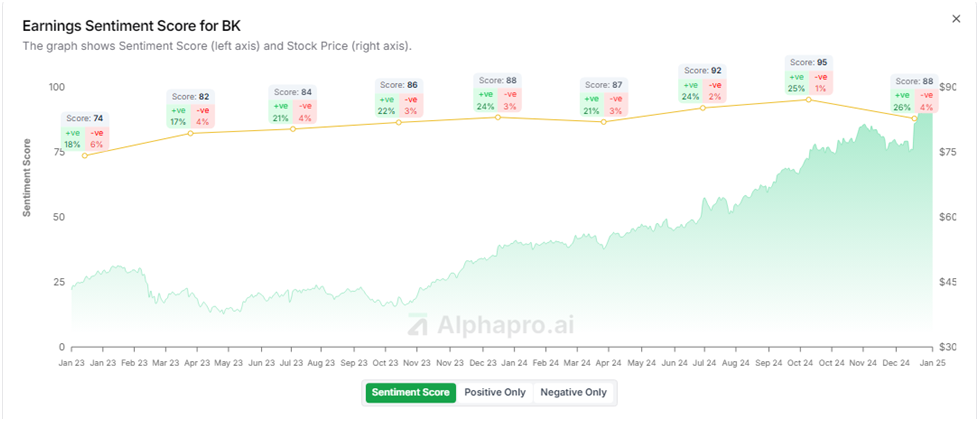

- Non-interest expense: The Bank of New York Mellon Corporation (BNY) Q4 2024 earnings call transcripts report was overwhelmingly positive, reflected in the stock’s performance post-announcement.

Positive Sentiments:

Several factors contributed to the positive market response following the earnings announcement:

- Fee Revenue Growth: The bank’s fee revenue increased by 9% to $3.51 billion, driven by higher market values, increased client activity, new business, and elevated foreign exchange revenue.

- Net Interest Income: There was an 8% rise in net interest income to $1.19 billion, primarily due to higher yields from the investment securities portfolio and balance sheet expansion.

- Expense Management: Non-interest expenses decreased by 16% to $3.36 billion, indicating effective cost management strategies.

- Assets Under Custody and Administration: The bank reported a 9% increase in assets under custody and administration, totaling $52.1 trillion, reflecting its expanding client base and market appreciation.

Negative Sentiments:

Despite the strong performance, certain aspects may warrant caution:

1. Macroeconomic Risks: Some investors remain cautious about economic headwinds, including the potential impact of interest rate cuts on net interest margins.

2. Regulatory uncertainty: Concerns over potential banking regulations and capital reserve requirements have led to some hesitation among institutional investors.

3. Lonic, and with a focus on innovation, risk management, and financial resilience, The Bank of New York Mellon Corporation (BNY) is well-prepared to maintain its leadership in the financial sector.

4. g-Term Sustainability of Cost Reductions: While cost-cutting measures have improved profitability, some analysts questioned whether BNY Mellon can sustain these savings without compromising operational effectiveness.

Strategic Outlook for 2025

Looking ahead, The Bank of New York Mellon Corporation (BNY) plans to focus on several key areas to drive growth:

- Technology & Digital Transformation: Investments in AI-driven financial solutions and digital banking will enhance client services and efficiency.

- Global Expansion: Expanding its presence in Asia and Europe to capture high-growth markets.

- Diversified Asset Management Solutions: Offering customized financial solutions to attract more institutional and retail investors.

- Sustainable Finance Initiatives: Enhancing ESG (Environmental, Social, and Governance) practices to align with global sustainability trends.

Conclusion

The Bank of New York Mellon Corporation (BNY) Q4 2024 earnings call transcripts showed enhanced cost efficiency, excellent revenue growth, and solid financial performance. Its strategic goals, technological investments, and client-focused approach position it for ongoing success in 2025, despite the persistent worries about market risks and macroeconomic unpredictability.